48 Flavours of Bookkeeping Support

At Tashly Consulting we work with a diverse range of businesses of all shapes and sizes, ranging from sole traders all the way up to organisations trading internationally

Having been in business for over twenty years now, we have many clients who have been with us for years and it is an honour to have played a role in helping them grow and achieve amazing success

48 Flavours is one of those success stories. Brian O’Donnell started the iconic local ice cream business with his daughter in 2014 and engaged Tashly Consulting to help with bookkeeping when the business started expanding with the purchase of a second store and manufacturing centre

We recently sat down with Brian and asked him to reflect on his time working with Tashly Consulting.

“When we bought the second store we were more than six months behind in our bookkeeping and we weren’t confident we were compliant with the legislation at the time.

Our systems and reporting were incomplete, and we desperately needed help to get our bookkeeping up-to-date and in line with our financial reports so we could move forward.

Natasha and her team brought everything up to date and integrated our bookkeeping with our point-of-sale systems which enabled much easier reporting. They also helped us move from MYOB to Xero and we found the transition very worthwhile.

48 Flavours Is A Family-owned Gelateria that produces an upmarket range Of Artisan Gelato using Fresh South Australian Produce.

We knew we needed a concise and easy to understand system that would give us accurate information so we could make informed decisions. We also wanted to ensure we were meeting our legal requirements in relation to reporting.

Our old system was incredibly inefficient, and we struggled to keep up with the required reporting, particularly to the ATO.

We are now very well-organised and having the correct information at our fingertips has helped us expand to four outlets. We’re now looking at an interstate expansion!

It’s also very reassuring to know that we are up-to-date with our obligations and compliance, and our financial reports are always completed on time because our books are immaculate.

I would not hesitate to recommend Tashly Consulting to other businesses looking for Xero Training, Consulting or Bookkeeping support.

I’m sad to say that we are no longer a client of Tashly Consulting, but this is because we have grown so much we can now support the bookkeeping and finance functions in-house with our own dedicated staff.”

source video by: 48 Flavours – © copyright 2022.

While we’re always sad to see a Tashly Consulting client leave us, having a business outgrow us and set up their own in-house finance function is a wonderful outcome, and we wish Brian and his team every success as 48 Flavours continues to expand.

If you haven’t already, check out this family-owned gelateria at one of their four locations. With a daily production of over 100 varieties of dairy, sorbet, vegan, and low-fat options, flavours are changed and rotated every day with something new and exciting to try at every visit.

Featured Image (L to R) Brian O’Donnell, Stephanie O’Donnell, Jeevan – Investor (Rad Adventures) | Edited by @tashlydesign

Ready to accelerate your own success with Xero Training, Consulting or Bookkeeping support?

Get in touch with Tashly Consulting Xero Bookkeepers & Xero Training Adelaide – Not your average Bean Counter!

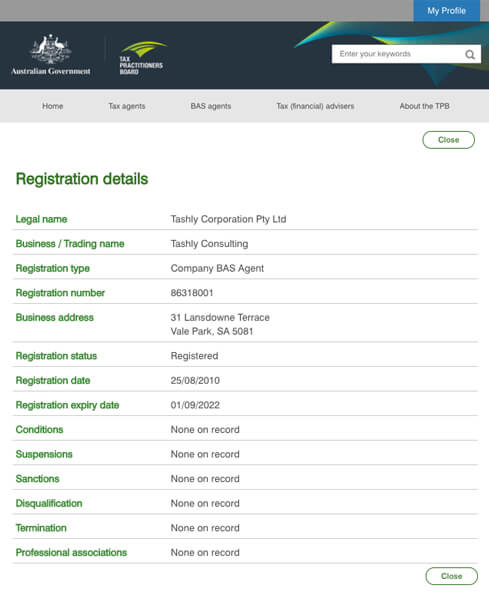

Tashly Consulting Xero Bookkeepers Adelaide are Registered BAS Agents #86318001, and we are dedicated to providing seamless, high-quality, transparent bookkeeping services – If you would like any further information please contact us via telephone (08) 8121 4424 or via email to discover how the multi-award-winning team at Tashly Consulting can help you better manage your business bookkeeping.

Disclaimer: All or any advice contained in this blog/newsletter is of a general nature only & may not apply to your individual business circumstances. For specific advice relating to your specific situation, please contact your accountant or other professional adviser for further discussion.