Bookkeepers, BAS Agents, and Accountants

Do you know who does what?

If you’re not a Bookkeeper or Accountant yourself, you might think that these two roles are very similar

And while it is true that both play an important part in helping to manage your business finances, there are some key differences between Bookkeepers and Accountants and how they support you to achieve business success.

Bookkeepers are involved in the day-to-day transactions and administration of your business finances

They make sure that money coming in and out of your business is accurately recorded by managing bank feeds and processing bank reconciliations, accounts receivable and accounts payable, and preparing regular financial reports.

Bookkeepers focus on accurately recording and organising your financial transactions so your Accountant can interpret that data, prepare financial statements and reports, assist with budgeting and tax planning, gain insights into the financial performance of your business, and provide strategic advice.

As a business owner, it’s important to understand that a Bookkeeper can only interact with the ATO and manage ATO obligations on your behalf if they are also a registered BAS Agent, unless they are your employee. Registered BAS Agents can take care of ATO transactions such as preparing and lodging Business Activity Statements (BAS) and Single Touch Payroll (STP) on your behalf.

This summary highlights the key differences between Registered Bookkeepers & BAS Agent vs Accountants:

| Registered Bookkeeper, BAS Agent | Accountant |

| Affordable price points with regularly or monthly packages available | Higher fees / Hourly Rate |

| Focus on assisting with GST and PAYGW | Specialists in income tax, FBT, CGT, etc |

| Working with day-to-day details and transactions | Focused on high level business strategy |

| Updates records daily, weekly, fortnightly | Usually see once a year at tax time |

| Records and organises data | Interprets data and provides insight |

| Provides accurate and up-to-date information for Accountant | Provides Bookkeeper with understanding of business objectives |

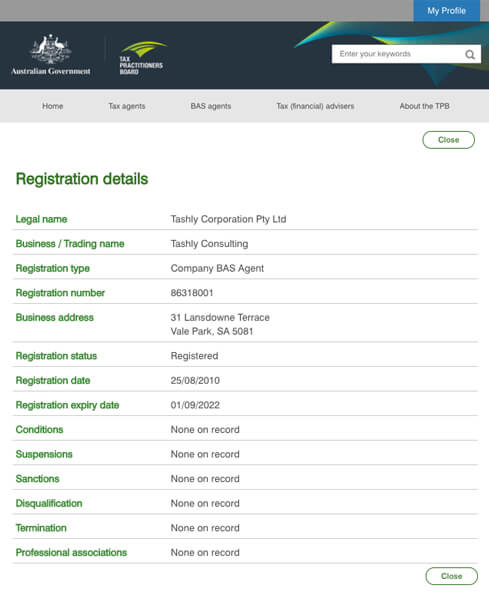

As Registered BAS Agents and members of the Tax Practitioners Board, Tashly Consulting manages ATO lodgements and obligations on behalf of business clients of all sizes, from sole traders to large employers. We liaise with our clients’ Accountants to ensure the best possible outcome for the business, and we have a great deal of respect for the strategic role an Accountant plays.

Our skilled and experienced team of Bookkeepers take pride in completing your bookwork accurately and with great attention to detail, removing the stress and burden of the bookkeeping function from you and your team, allowing you to get back to doing what you do best.

We offer Bookkeeping Rescue Packages if you need help tidying up your records, or have fallen behind in your obligations. We also offer Xero training if you would prefer to keep your bookkeeping in-house but need help getting started, or would like to train up a Xero skilled staff member.

Tashly Consulting Xero Bookkeepers Adelaide are Registered BAS Agents #86318001, and we are dedicated to providing seamless, high-quality, transparent bookkeeping services – If you would like any further information please contact us via telephone (08) 8121 4424 or via email to discover how the multi-award-winning team at Tashly Consulting can help you better manage your business bookkeeping.

Tashly Consulting Xero Bookkeepers Adelaide – Not your average Bean Counter!

Disclaimer: All or any advice contained in this blog/newsletter is of a general nature only & may not apply to your individual business circumstances. For specific advice relating to your specific situation, please contact your accountant or other professional adviser for further discussion.

Images by Adobe Stock | Edited by @tashlydesign