Bookkeeping Terms – What Does It All Mean?

Not knowing bookkeeping jargon can be overwhelming, and it can be hard to know where to start.

If you’ve ever found yourself trying to understand what all these words and acronyms mean, but are only left more confused, here’s a quick and easy-to-understand breakdown of commonly used terms:

- Assets: these are the items of value to a business and can include cash on hand/in bank, accounts receivable, fixed assets such as vehicles, plant & equipment, or other receivable amounts.

- Balance Sheet/Statement of Position: a report which captures the assets, liabilities, and equity of a business.

- Bank Reconciliation: a process where the accounting records of bank transactions are verified against the banks record of transactions.

- Business Activity Statement (BAS): the monthly, quarterly, or annual reporting to the tax office for GST, PAYGW and PAYGI.

- Cash/Accrual: The two methods by which GST is reported to the tax office. The former requires you to report GST as you physically receive it, whereas the latter requires reporting as soon as you raise the sale (whether you’ve been paid or not).

- Chart of accounts (COA): a list of accounts that you can itemise your income, expenses, assets & liabilities into.

- Cost of Goods Sold (COGS): these are the costs that are directly connected to earning revenue.

- Creditors/Accounts payable (AP): refers to the bills you need to pay to your suppliers.

- Debtors/Accounts receivable (AR): invoices that your customer has not paid yet.

- EOFY: end of financial year.

- Equity: this is the difference between the assets and liabilities of the business.

- Financial Year: 12-month accounting period that a business uses for financial and tax reporting purposes – also known as a fiscal year.

- Goods & Services Tax (GST): the 10% tax to be collected/claimed on taxable goods and services.

- Gross profit: the profit available after direct costs (COGS) are deducted, but before general operational costs are deducted.

- Income statement/Profit & Loss (P&L): The record of revenue received, and costs incurred for a business, resulting in a profit or loss.

- Invoice/Tax Invoice: a document which shows the details of a transaction, such as a description of the transaction, the quantity of goods and/or services provided, the rate charged, total cost, as well as when/how the customer should pay. Where GST is reported, the document is known as a Tax Invoice. A business not registered for GST would use an Invoice.

- Liabilities: Debts owing by an organisation and can include overdraft balances, credit cards, asset loans, liabilities for staff obligations, liabilities for tax obligations.

- Net profit: The profit showing after recording of all direct and indirect costs.

- Opening balances: the balance of an account as a starting position, such as the beginning of the financial year, or when changing software.

- Overheads: costs relating to the running of the business which would occur whether revenue was derived that period, includes things such as rent.

- Pay as you Go Instalment (PAYGI): a rate of tax payable on income – can be set as a percentage of turnover, or a set instalment rate as pre-determined by the ATO based on prior year financial information.

- Pay as you Go Withholding (PAYGW): the tax withheld from employee wages, to be paid to the tax office.

- Remittance: a document to be sent to a supplier on payment detailing the bills paid in a payment.

- Retained earnings: the value or profit carried forward from prior financial years.

- Trial balance: a summary report including all account codes, combining profit & loss and balance sheet items.

- Turnover/Revenue: the income earned by a business.

These are just a handful of commonly used terms, and with them, you’ll be able to increase your vocabulary, and understanding about the bookkeeping world.

Hopefully this guide was able to provide some clarity, allowing you to be comfortable and confident with communication and understanding around your finances. If you are ever unclear on your numbers, or any financial terms/definitions, do not hesitate to reach out to your bookkeeping or accounting professional for support. We love it when clients ask questions!

If you would like to learn more, the Xero website has an extensive glossary of bookkeeping terms.

At Tashly Consulting, it is of utmost importance to ensure our clients have a clear understanding, and therefore confidence, of their business finances. We offer Adhoc Consultations via zoom meeting, or face to face, for any queries you may have, as well as Bookkeeping Rescue Packages if you need help tidying up your records or have fallen behind in your obligations. We also offer Xero training if you would prefer to keep your bookkeeping in-house but need help getting started or would like to train up a Xero skilled staff member.

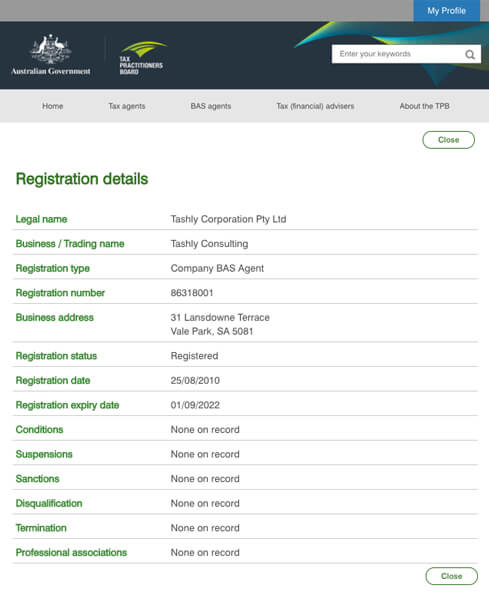

Tashly Consulting Xero Bookkeepers Adelaide are Registered BAS Agents #86318001, and we are dedicated to providing seamless, high-quality, transparent bookkeeping services – If you would like any further information please contact us via telephone (08) 8121 4424 or via email to discover how the multi-award-winning team at Tashly Consulting can help you better manage your business bookkeeping.

Tashly Consulting Xero Bookkeepers Adelaide – Not your average Bean Counter!

Disclaimer: All or any advice contained in this blog/newsletter is of a general nature only & may not apply to your individual business circumstances. For specific advice relating to your specific situation, please contact your accountant or other professional adviser for further discussion.

Images by Xero | Edited by @tashlydesign