Separating Your Business & Personal Finances

Why is separating your business and personal finances so important?

Though there are a myriad of reasons as to why you should separate your finances, the most important are: audit proofing your business, clarity around your numbers, and saving time and money.

Separating your accounts makes keeping track of your business expenses streamlined and efficient. It can save you money on bookkeeping and accounting fees by setting, and keeping, good banking habits. Your bookkeeper and accountant are then able to focus their time on actual business income and expenditure, rather than spending valuable time sifting through non-deductible personal costs.

Most business expenses may be tax deductible, but if your personal and business expenses are mixed in together, it is possible you may miss out on valuable tax write-offs.

In the case of an audit, tracking and validating your business expenses will be quick and efficient, meaning you can approach an audit with confidence and assurance. In our experience, where a tidy and reconciled set of accounts can be demonstrated to the auditor, you have shown you are compliant, and therefore a lower risk.

According to the ATO, if you are a partnership, company, or trust, your business and personal expenses MUST be kept separate.

When you have separate accounts, you allow yourself a far more organised financial picture, making tracking your spending, and other financial processes, streamlined. When running reports, you can accurately see the health and financial position of your business.

Therefore, our recommendation is to isolate your business expenses from your personal spending through using separate bank accounts and credit cards. That way, when making financial business decisions, you know you have a set place to use.

The longer you leave both expenses in the same account, the more they build up, and it becomes exponentially harder to determine what your profit and expenses are for your business. So, start today to instigate good data hygiene habits!

Here at Tashly Consulting, we can help with setting up, separating, and sorting your accounts. Our aim is to provide help to new and existing business owners, ensuring you and your finances are in the best possible position.

We offer Bookkeeping Rescue Packages if you need help tidying up your records or have fallen behind in your obligations. We can also provide Adhoc Consultations via zoom meeting, or face to face, for any queries you may have, as well as Xero training if you would prefer to keep your bookkeeping in-house but need help getting started.

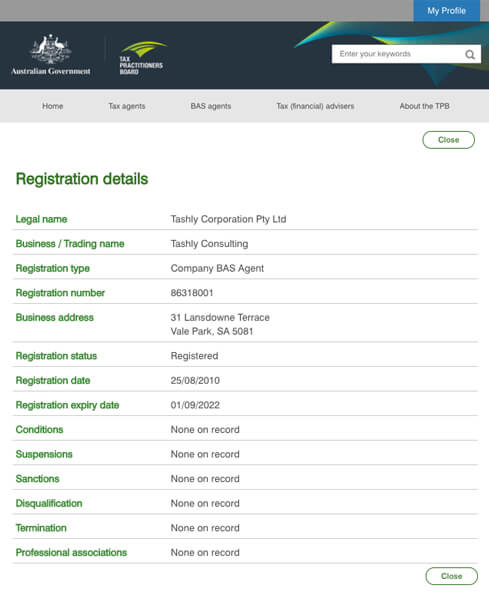

Tashly Consulting Xero Bookkeepers Adelaide are Registered BAS Agents #86318001, and we are dedicated to providing seamless, high-quality, transparent bookkeeping services – If you would like any further information please contact us via telephone (08) 8121 4424 or via email to discover how the multi-award-winning team at Tashly Consulting can help you better manage your business bookkeeping.

Tashly Consulting Xero Bookkeepers Adelaide – Not your average Bean Counter!

Disclaimer: All or any advice contained in this blog/newsletter is of a general nature only & may not apply to your individual business circumstances. For specific advice relating to your specific situation, please contact your accountant or other professional adviser for further discussion.

Images by Xero | Edited by @tashlydesign