Cash vs Accrual Reporting – What does it all mean..?

Cash vs Accrual Reporting: Learn the differences between these accounting methods and how they impact financial statements and decision-making

Cash Reporting:

Let’s start with cash reporting. This method is like keeping tabs on your piggy bank. You record transactions when cash actually moves in or out of your hands. So, if you sell a product and get paid right away, you count that as income when you received the cash, not when you sent the invoice.

Advantages:

• Easy to Understand: It’s simple—record transactions when money changes hands.

• Good for Small Businesses: If you’re just starting or have a small operation, cash reporting can be less complicated.

Accrual Reporting:

Now, onto accrual reporting. Think of this as keeping track of IOUs. With accruals, you record transactions when they happen, even if the money hasn’t landed in your bank account yet. So, if you send an invoice for a service, you count that as income as soon as you send the bill, regardless of when you receive payment.

Advantages:

• Shows the Whole Picture: Accrual reporting gives you a clearer view of your business’s financial health by including all transactions when they occur.

• Better for Long-Term Planning: It helps you plan ahead by showing what you’ve earned and what you owe, even if the cash hasn’t come in yet.

If you’re a new business owner in Australia, wrapping your head around taxes like the Goods and Services Tax (GST) is essential. One big decision you’ll face is how to report your GST: through cash or accrual methods. Don’t worry if these terms sound like jargon; we’re here to break it down in simple terms

Which One Should You Choose?It depends on your business and what feels right for you.

• Cash Reporting: If you prefer simplicity and have straightforward cash flows, this might be your best bet.

• Accrual Reporting: For a more accurate picture of your financial health and if you want to plan for the future, accruals could be the way to go.

Bottom Line:

Both cash and accrual reporting methods have their pros and cons. As a novice business owner, you have the flexibility to choose the one that suits your needs best. Just remember to keep track of your transactions and stay on top of your GST reporting to keep the taxman happy!

Understanding the difference between cash and accrual reporting is a crucial step in managing your business finances effectively. By grasping these concepts, you’ll be better equipped to make informed decisions about how to report your GST and keep your business on the path to success.

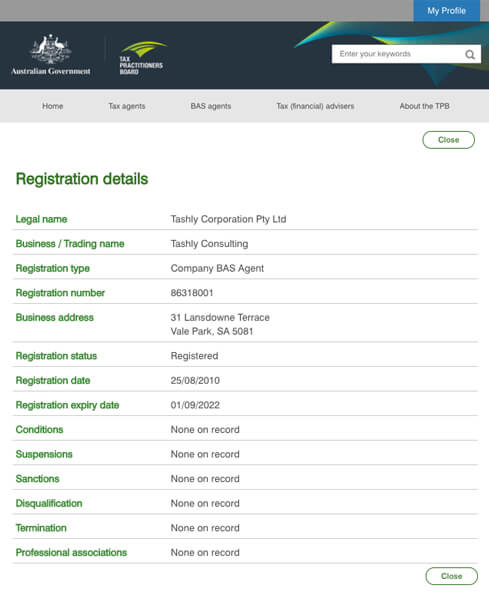

At Tashly Consulting, we are registered BAS Agents with the ATO and are well versed in both methods of GST reporting and can assist you with preparation of your BAS, ensuring the correct figures are calculated and reported to the tax office.

We offer Bookkeeping Packages and BAS Review & Lodge Services if you need help tidying up your records or have fallen behind in your obligations. We can also provide Adhoc Consultations via zoom meeting, or face to face, for any queries you may have, as well as Xero training if you would prefer to keep your bookkeeping in-house but need help getting started.

Tashly Consulting Xero Bookkeepers Adelaide are Registered BAS Agents #86318001, and we are dedicated to providing seamless, high-quality, transparent bookkeeping services – If you would like any further information please contact us via telephone (08) 8121 4424 or via email to discover how the multi-award-winning team at Tashly Consulting can help you better manage your business bookkeeping.

Tashly Consulting Xero Bookkeepers Adelaide – Not your average Bean Counter!

Disclaimer: All or any advice contained in this blog/newsletter is of a general nature only & may not apply to your individual business circumstances. For specific advice relating to your specific situation, please contact your accountant or other professional adviser for further discussion.

Images by Xero | Edited by @tashlydesign