It’s EOFY 2019….are you ready?

CLICK TOPIC links to read more…

THINK SUPER

SINGLE TOUCH PAYROLL

PAYG PAYMENT SUMMARIES

RETURN TO WORK SA

APRIL TO JUNE, BAS DUE

EMPLOYEE ENTITLEMENTS

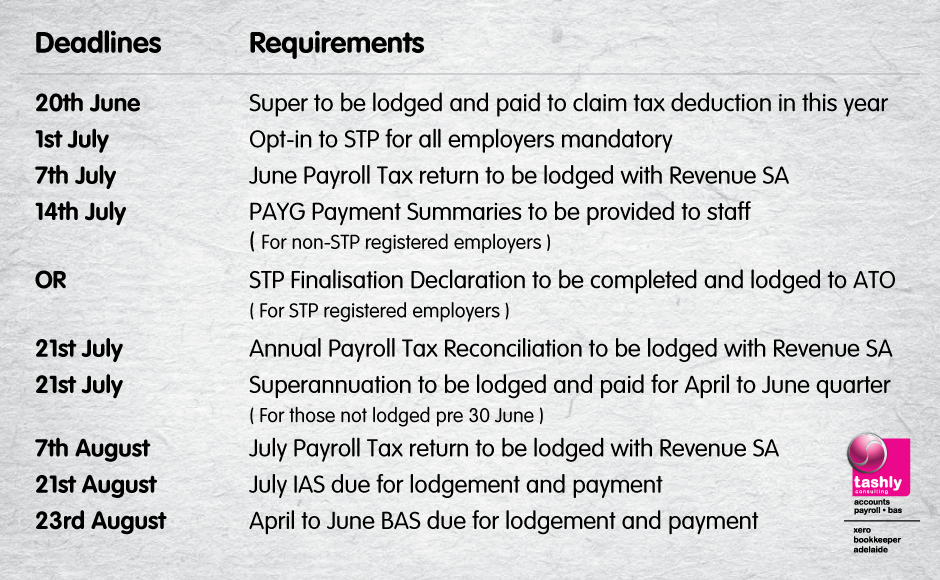

IMPORTANT DATES

THINK SUPER

As we draw closer to 30 June, consideration may need to be given to your staff super payments. Although the April to June quarter super payments are not legally required to be paid and received by the super funds until 28th July, you may wish to consider bringing forward your final contribution for this year to prior to 30 June.

The ATO advises that you can only claim a tax deduction in the financial year in which you pay the super and that the employee super funds have received the payment. Unfortunately, we cannot control how quickly the super funds process their payments and cannot see the date that funds determine they have received the funds, so we recommend that any super payments made via your Clearing House be completed at least a week prior to 30 June.

It is possible to lodge multiple super contributions payments, so there may be advantages to lodging the bulk of your superannuation early and submitting only the final payrun super contributions in that final week if that is how your pay cycle falls. This would still provide you with the maximum tax deduction possible for the year for your staff superannuation.

In summary:

1. If you wish to claim your super contributions in this financial year – payment must be made and received prior to 30 June (we recommend you pay all or most of your superannuation at least a week prior to ensure it is received by the funds in time)

2. If you are not too concerned about claiming the tax deduction in this financial year – you have until the 28th July deadline to lodge and pay (again recommendation is made that the lodgement/payment be made at least a week prior to this deadline to ensure payment has been received on time by the funds)

SINGLE TOUCH PAYROLL

Single Touch Payroll (STP) is here and is mandatory for all employers to be opted-in from 1 July 2019. Employers of greater than 20 employees should generally have been opted in for the current financial year, with all other employers required to join them for the new financial year. There are a few exceptions to this rule that can be found here – view link, however, the majority of businesses are now required to comply.

We have already been assisting to ensure clients we process payroll for are compliant and opted in before the end of year rush, and encouraging clients managing their own payroll to do the same. For clients using Xero, there is a process to follow to establish the Single Touch Payroll which includes a phone call to the ATO, which generally takes less than 10 minutes to finalise. Once opted in, employers are required to report each pay event to the ATO with a simple click of a File button. Nothing further changes regarding your payment obligations for wages, tax or super. One thing to note however is that once a pay event has been lodged, you are unable to make any changes to it. Alterations or corrections will need to be made in a subsequent or unscheduled pay run.

It is important to note that once an employer has opted in for STP, they are no longer required to provide an annual PAYG Payment Summary to their employees. Employers are still required to run their usual end of financial year reconciliations for payroll and lodge an STP Finalisation Declaration to the ATO. When employees come to prepare their tax return this information will be accessible via their MyGov portal as the ATO already has this information from the STP lodgements. If your business is opted in for STP we request your assistance in communicating this change to your employees and they can be directed to further information on the ATO website – view link

PAYG PAYMENT SUMMARIES

Both the PAYG Payment Summaries (for non STP employers) or the Annual STP Payroll Finalisation Declaration (for STP compliant employers) are required to be prepared annually and lodged no later than 14 July and can be prepared once you have completed your final payrun for the current financial year and after all reconciliations to confirm accuracy are complete. If we are engaged to assist you with your payroll processing, this service is included in your package and we will be in touch prior to 14th of July to receive your authorisation to lodge. If you require assistance with this service and are not currently engaged by us to process your payroll, please contact our office to discuss your specific needs.

RETURN TO WORK SA

Return to Work SA Annual Reconciliation – If you are a South Australian business with workers paying wages exceeding the $12,809 threshold, you are required to be registered for and pay workers compensation premiums. Historically, each year you are required to make an estimate of the remuneration you will be paying your employees and lodge with Return to WorkSA who will determine an applicable amount payable (either annually or monthly). This year they are providing employers an option to have their annual levy payable based on either an Estimated Remuneration or Actual Remuneration. Essentially the Estimated Remuneration option is in alignment with how levies have been calculated in historic years, with a final adjustment at year end available for both under/over payments.

The new option now available is that RTWSA are allowing you to nominate your Actual Remuneration for the prior year to be used as the basis for calculation of your levy for the new financial year, however there will be no end of year adjustment. This has the possibility of either working for, or against your business, depending on the fluctuation in your staffing levels. They have provided that if your business experiences financial hardship causing a significant decrease in remuneration, you can apply for a premium adjustment. Further information can be found here – view link.

If you engage Tashly Consulting to assist with your annual reconciliation, we will discuss the options available to you.

APRIL TO JUNE – BAS DUE

The April to June BAS will also be looming for preparation, lodgement and payment. We are advising all clients that the cut-off lodgement date for Tashly Consulting clients this quarter is 22nd August and request that all information be provided to us at least 14 days prior to enable us time for scheduling and processing of the work. Any information received after this date will not be lodged until late September and could incur late fines and penalties from the ATO. We encourage you to contact us early if you have any queries or concerns around these deadlines.

EMPLOYEE ENTITLEMENTS

The Fair Work Commission’s Minimum Wage Panel handed down its Annual Wage Review decision on 30th of May, announcing an increase of three per cent to the national minimum wage to all Modern Awards. These changes are effective from the first full pay period commencing on or after 1 July 2019. We strongly recommend that you view your employee contracts and pay rates to ensure that you are paying at or above award rates and adjust the pay rates as required. It also an opportune time to review and ensure you are paying all employee allowances, loadings and penalties in compliance with your awards. If you have any concerns around your HR matters, we do have affiliations with HR agencies who can assist you with this process.’

Tashly Consulting Xero Bookkeepers Adelaide are Registered BAS Agents #86318001 and we are dedicated to providing seamless, high-quality, transparent bookkeeping services – If you would like any further information please contact us via telephone (08) 8121 4424 or via email.

Tashly Consulting Xero Bookkeepers Adelaide – Not your average Bean Counter!

Disclaimer: All or any advice contained in this blog/newsletter is of a general nature only & may not apply to your individual business circumstances. For specific advice relating to your specific situation, please contact your accountant or other professional adviser for further discussion.